Advantis Credit Union is a member-centered economic institution that operates in the realm of banking and economic services. As a not-for-profit cooperative, Advantis Credit Union stands aside from conventional banks in its technique to business and purchaser relationships. It serves individuals and agencies, with an emphasis on offering price-driven economic products and services. In the broader industrial business enterprise landscape, Advantis Credit Union performs a huge function by means of imparting crucial monetary sources to businesses, improving financial interest, fostering entrepreneurship, and contributing to network development.

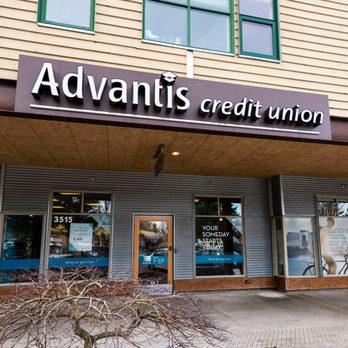

1. Introduction to Advantis Credit Union

Founded in 1928, Advantis Credit Union is based totally in Oregon, United States. Originally serving the employees of a selected organization, it has progressed its membership to embody those who live or art work in unique geographic areas. Advantis Credit Union operates with a cooperative version, that means it is owned and operated by using its participants, who are each customers and stakeholders in the business agency.

Unlike conventional banks, which might be normally for-earnings establishments, credit score unions like Advantis reinvest their income into the offerings they provide, offering decreased prices, higher interest quotes, and personalized carrier. This cooperative form emphasizes the welfare of the membership, in desire to maximise shareholder earnings.

2. Advantis Credit Union’s Role in Supporting Businesses

One of the most excellent methods wherein Advantis Credit Union affects business employers is by way of manner of offering a huge range of financial services and products designed to fulfill the precise desires of entrepreneurs and company proprietors. Some key strategies Advantis Credit Union interacts with the corporation global include:

a. Business Loans and Credit Lines

Advantis Credit Union offers a ramification of mortgage merchandise to agencies, which include:

Business Term Loans: These loans assist agencies finance huge purchases, such as systems or property, with predictable reimbursement schedules.

Business Lines of Credit: A bendy mortgage that lets in agencies to borrow as much as a tough and speedy restrict as wanted, presenting liquidity to cowl jogging capital gaps or seasonal fluctuations in cash go along with the waft.

SBA Loans: As a partner of the U.S. Small Business Administration (SBA), Advantis gives SBA-sponsored loans that make it less complex for organizations to co-fund with favorable terms, in particular for small agencies and startups.

B. Business Checking and Savings Accounts

Businesses need dependable, on hand, and less luxurious banking services, and Advantis affords more than a few industrial corporations checking and savings money owed to fulfill those desires. These bills are tailored to the operational goals of small and medium-sized companies (SMEs) and large companies alike.

- Business Checking: Advantis checks money owed that accommodate each day financial operations, inclusive of payroll, dealer payments, and dealing with income.

- Business Savings Accounts: These bills offer corporations a way to store and broaden their capital, whether or not or no longer for destiny investments or as a buffer for unexpected expenses.

C. Merchant Services

Through its merchant services services, Advantis Credit Union allows businesses to take shipping of payments from customers, improving their cash drift and customer convenience. These services consist of:

- Point of Sale (POS) Systems: Equipment and software program application that agencies use to method credit score and debit card payments.

- E-trade Payment Solutions: Providing groups with the capability to safely accept online bills, essential for modern-day trade.

- Payment Processing Services: Helping businesses manipulate their transactions with green, secure fee processing infrastructure.

D. Business Insurance Services

Businesses need protection in opposition to dangers, and Advantis Credit Union works with its companions to offer complete coverage options, together with:

- Property Insurance: To protect bodily property like homes, inventory, and machines.

- Liability Insurance: To cover crook dangers related to enterprise operations.

- Workers’ Compensation Insurance: To make sure agencies can offer help to employees injured inside the course in their paintings.

These coverage merchandise are imperative for making sure companies are covered from monetary worry because of unforeseen activities.

Also read san mateo credit union

3. Advantis Credit Union Role in Community Economic Development

In addition to at once serving businesses, Advantis Credit Union plays a position in broader community monetary improvement. By supporting nearby agencies with get entry to capital, financial schooling, and network-focused monetary offerings, Advantis contributes to the overall fitness of the close by financial machine.

Supporting Small Businesses and Entrepreneurs: As a credit score union, Advantis is dedicated to assisting small corporations and startups, often imparting favorable terms for financing compared to standard banks. Many of those companies are key drivers of neighborhood interest introduction, innovation, and community well-being.

Financial Education for Business Owners: Advantis also gives financial literacy applications and workshops designed to help entrepreneurs manipulate their commercial enterprise budget better, plan for the future, and make informed decisions.

Community Investment: Advantis reinvests its profits into the local community with the resource of assisting projects that benefit underserved populations, promote economic literacy, and toughen community agencies.

4. Competitive Advantage of Advantis Credit Union for Businesses

Advantis Credit Union offers numerous aggressive blessings for groups that make it a suited monetary accomplice, particularly as compared to conventional business banks:

Lower Fees: As a no longer-for-earnings group, Advantis can provide business offerings with decreased costs than maximum business banks, which may be a considerable value-saving gain for small corporations.

Better Interest Rates: Businesses that borrow from Advantis often take advantage of extra favorable mortgage expenses, this is important in handling the charges of financing.

Personalized Service: Advantis places an emphasis on constructing relationships with its members. This personalized service could make it less complicated for enterprise owners to navigate financial disturbing conditions and preserve tailor-made advice on coping with their enterprise budget.

Focus on Local Businesses: Advantis has a deep willpower to its nearby network, which makes it a preferred associate for groups in search of artwork with establishments that recognize and are invested inside the nearby monetary gadget.

5. The Future of Advantis Credit Union’s Role in Business

As the monetary landscape continues to comply, Advantis Credit Union is well-located to assist corporations in innovative approaches. Some regions in which Advantis can also additionally similarly amplify its services include:

- Digital Banking Solutions: With the growing shift towards on-line and cell banking, Advantis might also moreover increase its virtual services to embody more superior gear for organisation account control, digital bills, and lending answers.

- Sustainable Business Practices: Advantis can also increase awareness on financing agencies that prioritize sustainability, social effect, and ethical commercial company practices, aligning with developing patron call for green and socially responsible companies.

- Integration of Emerging Technologies: Advantis may additionally need to discover the use of AI, blockchain, and other technology to enhance its organization offerings, decorate fraud safety, and streamline commercial enterprise loan software tactics.

6. Conclusion

Advantis Credit Union plays a full-size function in the commercial enterprise international, now not simplest as an issuer of essential economic services however also as a key companion in assisting the increase and sustainability of companies within its network. By presenting tailor-made business loans, low value banking services, and fostering financial improvement, Advantis Credit Union contributes to the close-by economic machine, enables companies to thrive, and creates an extraordinary effect on communities. As a member-owned cooperative, its fulfillment is immediately tied to the prosperity of its business company contributors, which similarly strengthens its unique position within the economic offerings area.

Read More News Bunkeralbum